Charitable Remainder Uni-Trust: Tax Benefits and Long-Term Income Wrapped Up in a Charitable Gift

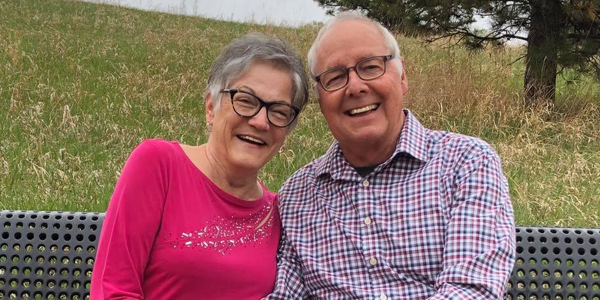

Michael and Kathy Schneider have lived in Bismarck since 1998, Valley City before that, and love giving back to their community. Volunteering at events and serving in different capacities for nonprofit organizations, the couple supports a variety of causes, but are especially drawn to programs that feed those in need.

"That is where our heart is," noted Kathy, who currently serves on the Great Plains Food Bank Board of Directors.

The Schneiders give of their time and treasure and, like others, learned this behavior from their parents.

"Both of our sets of parents gave money not only to the church, but

also to people in need,"

said Michael.

"One day after a school event, a bunch of us kids were going to go to a

matinee. And I remember my mother quietly giving me some money for one

of the kids because she knew he wouldn't be able to afford it. Those

things stay with you."

"Both of our sets of parents gave money not only to the church, but

also to people in need,"

said Michael.

"One day after a school event, a bunch of us kids were going to go to a

matinee. And I remember my mother quietly giving me some money for one

of the kids because she knew he wouldn't be able to afford it. Those

things stay with you."

The Schneiders generosity also includes financial contributions to the causes they support.

"We were discussing ways to lower our tax implications and our financial advisor told us to speak to Kevin Dvorak at the North Dakota Community Foundation," said Kathy. "Kevin was really, really helpful. He was very clear and he knew what we could do that would actually be the best for us."

The Schneiders established a Charitable Remainder Uni-Trust at NDCF. The uni-trust generates annual income for the Schneiders. The remainder will establish a permanent endowment fund that will support their designated beneficiary organizations when they pass, thus creating a legacy that will do good things in their name forever. Because a portion of their gift qualified for a federal tax deduction as well as the state's 40% income tax credit, the Schneiders received a substantial tax benefit.

"In the end, we saved just about as much in taxes as we actually put into the fund," said Kathy.

The Schneiders are free to use their annual payment from the trust on anything they want or need, although they usually donate it to one of the nonprofit organizations they support. They especially appreciate the ability to name the charitable beneficiaries of their uni-trust, and make changes to those beneficiaries, if necessary.

Overall, the Schneiders are very pleased with the returns from their uni-trust and their experience in working with NDCF.

"We didn't come to NDCF because we knew about the foundation. We came

because our financial advisor advised us to talk to them,"

explained Kathy.

"And that's when we started learning and looking deeper into all the

things that they do. Just the whole concept was really great. I wanted

to belong to an organization that was really broad, that had lots of

different ways of giving and supporting people. The foundation is just

absolutely marvelous."

"We didn't come to NDCF because we knew about the foundation. We came

because our financial advisor advised us to talk to them,"

explained Kathy.

"And that's when we started learning and looking deeper into all the

things that they do. Just the whole concept was really great. I wanted

to belong to an organization that was really broad, that had lots of

different ways of giving and supporting people. The foundation is just

absolutely marvelous."

While both Michael and Kathy are passionate about the causes they support and effusive in their compliments of NDCF, they are quick to deflect any praise of their own giving.

"Whatever we get involved with, we're just playing one part in the community and there's a lot of people that are doing this," Michael explained. " When these people work together - whether they donate a dollar or $100,000 - that's what makes it all possible. So we're just one in the queue. And we're humbled to be in that group."